The global supply chain has become increasingly complex over time. With the rise of Amazon, consumers expect packages to arrive the next day or even the same day, which requires extensive planning. The industry has also seen a growing number of regulations designed to accomplish everything from curbing emissions to ensuring food safety.

The ATA’s Technology and Maintenance Council (TMC) recently surveyed 12 of the top 15 trailer rental/lease companies in North America to learn about the technologies they use, their experiences and challenges with them, what their customers use/request, and their plans for the future. The group published these findings in an extensive research report and outlined them in a recent webinar.

Let’s look at these findings and where the smart trailer market is heading over the coming years.

The TMC's recent smart trailer survey found that, while GPS is almost ubiquitous across the industry, telematics is just starting to hit its stride. Share on XA mobile resource management report by C.J. Driscoll and Associates, published in early 2019, suggested 23 percent of the six million trailers in operation had some sort of tracking electronics. Information regarding the future of trailer electronics was presented in 2019 at the Truckload Carriers Association 81st Annual Convention. At that event, panelists forecasted the industry would increase the use of mobile resource management (telematics/trailer tracking)

to 42 percent by next year, 2022.

Industry Challenges

The trucking industry has never been busier than it is today, but at the same time, it faces many challenges: There’s a driver shortage, fuel costs are on the rise, trailer leases booked for over a year, and the list goes on.

The TMC’s webinar focused on three significant challenges:

- Theft: Cargo theft is a $15 billion to $35 billion problem in the United States, according to the NICB. Depending on the cargo, thieves can steal thousands to millions of dollars worth of merchandise, such as electronics or pharmaceuticals.

- Safety: The Food Safety and Modernization Act introduced new rules for refrigerated transportation. At the same time, Wal-Mart and other retailers have requirements that go above and beyond government regulations to ensure food safety.

- Regulation: Environmental regulations have become increasingly strict for trucking companies. For example, a new trailer proposal in California would require newly manufactured reefers to use a refrigerant that doesn’t have a negative global warming impact.

In addition to these challenges, trailers are held for even longer periods of time. Trailer service life has often been quoted being 15-20 years. The study shared that some first-time buyers of a trailer may keep it for as little as 5-7 years based on the original equipment manufacturer

(OEM) warranty, while others may keep the trailer for 20-25 years. Final use of a trailer is often as storage at businesses and farms.

Many of these challenges are solvable with the help of technology. For example, Powerfleet’s reefer trailer tracking and monitoring solution, the LV-400, enables companies to provide retailers with documented temperature and humidity readings during transit rather than just at the point of loading and unloading the trailer. Similarly, liftgate monitoring and GPS tracking can help prevent theft and aid recovery.

Technology Push vs. Pull

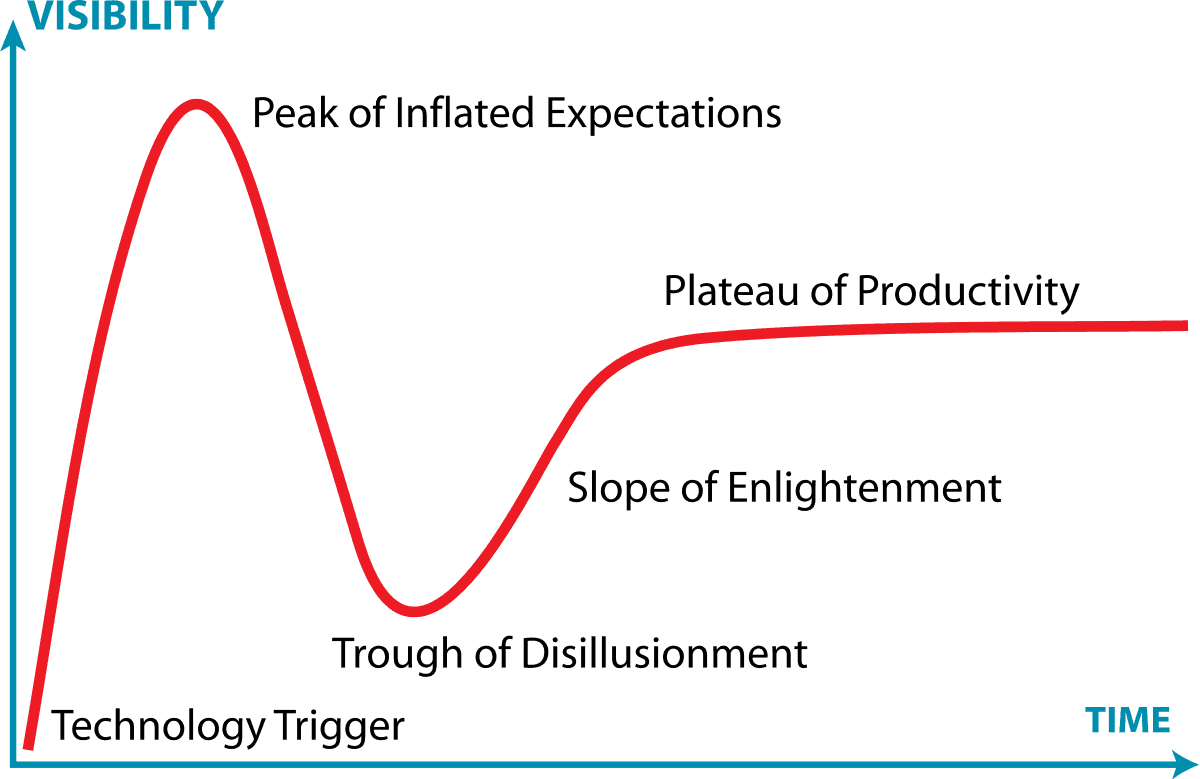

Technology suppliers are always coming up with new ideas to solve these problems. Many of these technologies follow a similar growth curve, known as the Gartner Hype Cycle. The TMC’s report looks at new fleet technologies through the lens of the Gartner Hype Cycle to understand where fleets are in the adoption process.

Gartner Hype Cycle – Source: Wikipedia

According to TMC’s report, a number of examples in the trucking industry (e.g., ABS, automated mechanical transmissions, digital displays) have shown it takes 20-30 years for a new innovation to go from start to a high percentage of new production and may never reach 100 percent unless mandated by law.

The report hypothesized that rental and leasing fleets can be a way of testing new technology in a variety of applications while minimizing risk. The survey conducted asked about their interest and that of their customers in the following technology areas for trailers:

• Trailer global positioning system (GPS)

• 3G/4G/5G telecommunications

• Variable frequency tracking/location updates

• Geofencing

• Door open/closed

• Loaded/empty status

• Interior temperature/humidity

• Power source

• Reefer/heater monitoring

• Tire pressure management

• Liftgate monitoring

• Wheel end and brake monitoring

• Backup and/or proximity sensors/cameras

• Onboard trailer weigh scales

• Light and/or electrical gateway hubs

With a 2.5-to-1 trailer-to-tractor ratio, most innovation focuses on the four to six million trailers in North America alone. For example, real-time tracking and predictive analytics aim to optimize asset utilization, reduce maintenance costs, improve safety, and reduce liability. These technologies will help boost efficiency and generate a meaningful ROI.

The key is suppliers and fleets working together to develop and implement these solutions. To that end, the TMC’s eSMART program is looking to create standards that ensure interoperability between different technology platforms and ultimately transform trailers from “dumb throwaways” to smart assets that generate an ROI.

4 Important Takeaways

The TMC webinar looked at four of the 12 essential technologies that fall along the Gartner Hype Cycle. The researchers look at the current state of adoption, what’s holding back fleets, issues and concerns, and potential benefits. This data could help both fleets and suppliers ensure that they’re keeping up with the latest trends.

The four critical areas include:

- Solar Power: The researchers found a high rate of solar adoption because battery power is often insufficient to meet trailer needs when disconnected from the tractor. Solar is a way to extend battery life and simplify recharging, especially in older trailers ill-equipped for smart products.

- Standardization: The researchers found that the lack of industry standards is a significant impediment to technology adoption. Many rental/lease fleets have one or two preferred telematics providers but want to ensure that technologies from different providers work together, particularly when it comes to data generation. Since these fleets deal with tens and hundreds of different carriers, they are interested in standardization to make installation and maintenance easier and less prone to failures.

- Customers: The researchers point out that customers are the most significant driver of technological change. While GPS is a ubiquitous requirement, many customers aren’t asking for telematics yet. Instead, rental/lease fleets are exploring telematics on their own as a way to differentiate their trailers from the competition.

- Field Upgrades: Over-the-air updates are inherently harder for trailers than tractors since there’s not always a power source of cellular connection. Hardware upgrades can be even more time-consuming than software updates. In addition to picking the right technology, fleets must ensure they can keep them updated. For example, the 3G sunset is underway and fleets are needing to address their existing technologies before they become obsolete.

Powerfleet provides a range of solutions designed to address these needs and requirements. For example, our award-winning trailer tracking LV-500 provides solar-powered super-capacitors and long-lasting batteries, enabling optimal visibility of assets and cargo, along with over-the-air updates and a powerful AI to translate data into actionable insights.

The Bottom Line

Smart trailers are still early in the Gartner Hype Cycle, but some technologies offer a considerable benefit already. Rental/Lease Fleets are increasingly getting requests for additional features for more intelligence on trailers. Over the coming years, fleets can look for many of these technologies to standardize and evolve to become more reliable. Meanwhile, early adopters can benefit from the valuable experience and early ROI.

The TMC’s full report looks at everything from electronic device failovers to 4G vs. 5G to GPS issues. To learn more about Powerfleet’s smart trailer solutions and more such as trailer tracking, freight cameras, dash cams, ELDs, visit our Logistics solutions page or contact us to speak to a telematics expert.